Here is a quick summary of the Ibuprofen market world wide for the 2025 first quarter, as you can see the segment has already been effected by tariffs and cost increases. With the latest news regarding EU 50% tariff’s here is where to look next for a safe haven.

North America

In Q1 2025, the Ibuprofen market in the United States witnessed fluctuating price trends influenced by shifting demand patterns, evolving trade policies, and logistical disruptions. In January, prices surged due to robust pharmaceutical demand, tight supply conditions, and logistical bottlenecks at key ports such as Los Angeles. Rising freight rates, longer clearance times, and limited inventory flexibility further intensified cost pressures, allowing manufacturers and distributors to benefit from improved profit margins.

However, this upward momentum reversed in February as demand weakened and inventory levels rose. Pre-emptive stockpiling ahead of the Lunar New Year and anticipated tariffs on Chinese imports led to market oversupply. Reduced transpacific freight rates and stable production costs in exporting countries made imports more competitive, compelling domestic suppliers to lower prices. Additionally, economic uncertainty and cautious procurement behavior further suppressed demand. By March, Ibuprofen prices continued to decline during the early part of the month due to elevated inventories and subdued consumption.

However, the U.S. government’s imposition of tariffs on major trading partners, including China, on March 4 prompted accelerated procurement, particularly from the pharmaceutical sector. This led to short-term upward pressure on prices. Port congestion and logistical constraints at hubs like Savannah and New York/New Jersey further delayed imports, tightening availability in the spot market Overall, the quarter closed with a mixed pricing trajectory-initial gains, mid-quarter decline, and late-quarter stabilization.

Asia Pacific

In the first quarter of 2025, the Ibuprofen market in China experienced notable price fluctuations, shaped by dynamic shifts in supply-demand conditions, seasonal factors, and international trade developments. January began with an upward pricing trend, fueled by robust export demand as global buyers particularly from the U.S. —accelerated procurement ahead of potential tariff changes under the new administration. This demand surge, coupled with post-holiday logistical constraints, rising freight costs, and marginal increases in raw material prices, drove Chinese suppliers to adjust their pricing strategies following late-2024 destocking efforts.

However, February saw a sharp reversal, with prices declining significantly due to oversupply and muted domestic consumption. The Lunar New Year holiday further slowed industrial activity, while high global inventories and ongoing trade restrictions constrained export opportunities. These conditions led to weakened demand and forced manufacturers to cut prices to manage surplus stocks. In March, prices rebounded amid a tighter supply landscape and stronger domestic and global demand.

Pre-holiday inventories had been cleared at discounted rates, and as production resumed, higher input costs-such as labor, energy, and raw materials pushed prices upward. Additionally, port congestion and logistics delays hindered timely shipments, while a revival in the pharmaceutical and food sectors, along with a PM of 50.5, signaled improving industrial activity. Overall, Q1 2025 reflected a volatile yet resilient Ibuprofen pricing environment in China.

Europe

In Q1 2025, the Ibuprofen market in Germany experienced a fluctuating yet overall upward price trend, influenced by evolving demand patterns, supply dynamics, and logistics challenges. January began with a modest price increase, driven by strategic stockpiling from buyers anticipating disruptions during the Lunar New Year in Asia. The food-grade preservative and pharmaceutical sectors, in particular, were active in procurement, maintaining healthy inventories while navigating logistical challenges like blank sailings and extended delivery timelines.

However, in February, prices declined due to weakened demand, high inventories from early stockpiling, and improved supply conditions. Eased logistics, marked by a sharp drop in ocean freight rates and an appreciating euro, further lowered import costs, prompting suppliers to reduce prices to clear stock. March witnessed a sharp price rebound amid widespread supply chain disruptions across Europe, including port congestion and labor strikes in Hamburg and other key ports, which constrained imports and bolstered supplier pricing power.

Meanwhile, restocking efforts resumed as downstream industries responded to tightening supply and declining inventories. Eased inflation and stable freight rates encouraged renewed procurement activity. By the end of Q1, Ibuprofen prices had risen overall, with March’s surge offsetting February’s dip. The quarter underscored the importance of strategic planning as the market remained sensitive to both global logistics shifts and domestic economic conditions, setting the tone for cautious optimism moving into Q2.

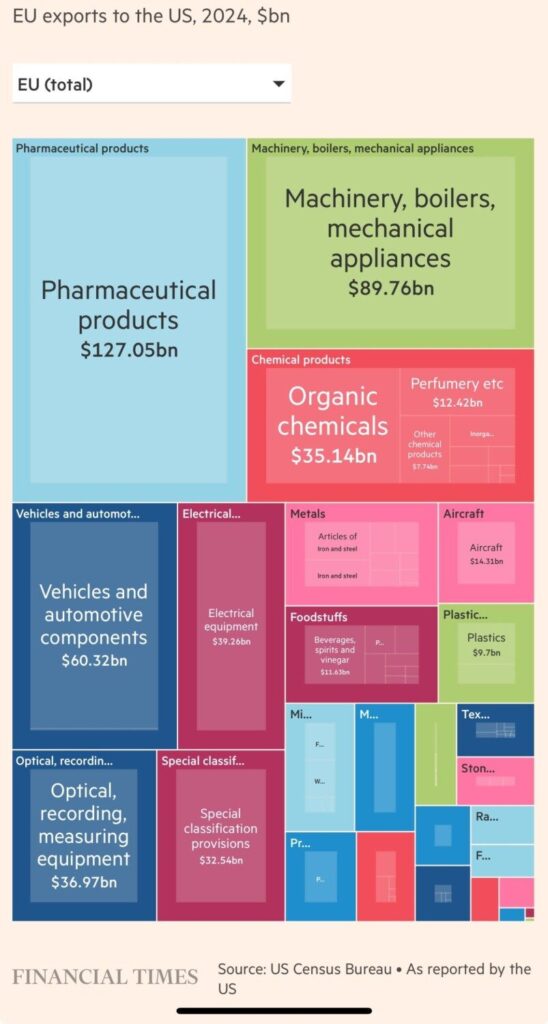

Here is the a breakdown of before and after tariffs are applied to the EU at the end of May, with the pause of the China tariffs coming to an end soon and they will default back to an large increased rate.

Chart 1 – shows that the EU is the recommended Ibuprofen Importer for the US.

Chart 2 – shows that the EU is no longer the recommended Ibuprofen Importer for the US.

Recommendations with the new current state – Cancel any purchase orders that are not going to incur any contract costs and move your short term current purchases of pharmaceuticals to safe haven’s like Switzerland and the UK.

Reach out with questions or support to these unique times.

Leave a Reply